Excitement About Offshore Wealth Management

Table of ContentsUnknown Facts About Offshore Wealth ManagementThe 20-Second Trick For Offshore Wealth ManagementSee This Report on Offshore Wealth ManagementOffshore Wealth Management Can Be Fun For EveryoneNot known Incorrect Statements About Offshore Wealth Management All about Offshore Wealth Management

The viewpoint priced estimate is for details just as well as does not make up investment guidance or a recommendation to any viewers to purchase or market financial investments. Any type of market info revealed describes the past as well as ought to not be seen as a sign of future market efficiency. You must consult your expert advisor in your territory if you have any kind of concerns relating to the materials of this short article.This includes taking actions to maximise the conservation and effective transfer of your estate to beneficiaries and also beneficiaries. In doing this, you require to consider who you want to benefit from your estate, just how and also when they must obtain the benefits, and also in what proportions. You must also determine individuals and/or firms that you want to be in fee of managing the distribution of your estate in a professional as well as reliable manner.

How Offshore Wealth Management can Save You Time, Stress, and Money.

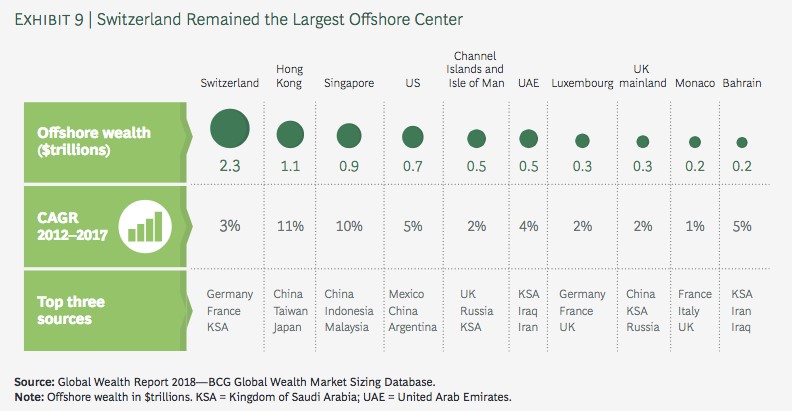

This makes Cyprus a cost-effective, yet high-grade choice for those who intend to manage their wide range in the EU. Singapore is just one of the largest as well as most prominent offshore economic facilities worldwide. Singapore has a great track record as a top overseas banking jurisdiction for high total assets individuals.

The financial sector has actually been the major driving force of the Luxembourg economic situation for numerous years now. The benefit of Luxembourg over other strong European countries is that there are no limitations on non-resident savings account. This makes it one of the most obtainable offshore banking jurisdictions in Europe. Luxembourg is most widely known for their premium financial investment financial services.

Offshore Wealth Management for Dummies

A Luxembourg overseas account can be opened up from another location within about two weeks. This is a tiny cost to pay for the variety of benefits that a Luxembourg wealth monitoring account offers.

It is highly a good idea to employ the solutions of a proficient as well as proficient overseas riches supervisor to assist you analyze and identify one of the most suitable options which are offered to you. They can also make certain that the configuration process is smooth and also reliable.

With considerable experience in the wide range monitoring industry, we show stability to bring you closer to wealth supervisors who have a comprehensive knowledge of off-shore investment, both worldwide as well as on the Channel Islands. We will just attach you with wealth managers that will promote a specialist trusting partnership with you which will motivate confidence as well as permit your off-shore financial resources to prosper.

Excitement About Offshore Wealth Management

We improve that procedure by initially, taking the time to discover regarding your present placement and future plans. This enables us to attach you with industry-leading wealth managers that can manage your portfolio, as well as your expectations, and support you to achieve your overall objectives.

They crucial problems are these:- They come in several guises and various bundles, so the reality that a fund is overseas tells you nothing regarding the framework, charges and so on. The policies that regulate the overseas financial investment might or may not be sufficient.

Compensation system security may not be as solid go right here as in the useful content UK. The tax ramifications depend quite on your tax obligation setting, not that of the fund. It is completely common for a fund to be excluded from any type of tax obligations in the nation in which it is based, however, for you to be fully taxed on any type of revenue, revenues or gains that the fund makes, either as it makes them or when you take them.

The Buzz on Offshore Wealth Management

There can be tax benefits for UK nationals living overseas, (or intending to do so for a minimum of an entire tax obligation year) or international nationals residing in the UK.

It is essential that you look for tax suggestions prior to carrying out any gifts or transfers of the policies.

Highly personal and high quality face-to-face advice is core to our culture. Our team believe that, as an exclusive customer, you should likewise have accessibility to the individuals handling your cash and also the people making the decisions regarding those managers, along with experts who can maintain you carefully notified on all elements of riches administration.

What Does Offshore Wealth Management Do?

We can aid you with opening up a variety of present and cost savings accounts offshore in any number special info of various base money. offshore wealth management.

Offshore financial investment cars include system counts on, mutual funds or investment firms. offshore wealth management. The overseas company will typically be situated in a nation where the mutual fund pays little or no tax obligation on its revenue or gains. While this does enable the investor some benefit while invested, if the earnings are brought back to the UK they will be exhausted then.

It should be birthed in mind that lots of offshore financial investments do not profit from the legal as well as regulatory protections that UK authorized investments have. These are funds which, although managed overseas, are allowed to market themselves directly to UK exclusive financiers. For a financial investment to be 'recognised' it will certainly either be an investment authorized by another regulator within the EEA, or it will certainly have offered details to satisfy the FCA that it gives 'sufficient protection' to financiers as well as is suitably handled.